Mortgage Market Update - March 10, 2025

|

The latest February employment figures have just been released, and while they didn't cause any immediate stir, they certainly provide the Bank of Canada with some food for thought as they prepare for this week's rate decision. Here's a concise overview: 🇨🇦 Canadian Jobs: Tepid at Best

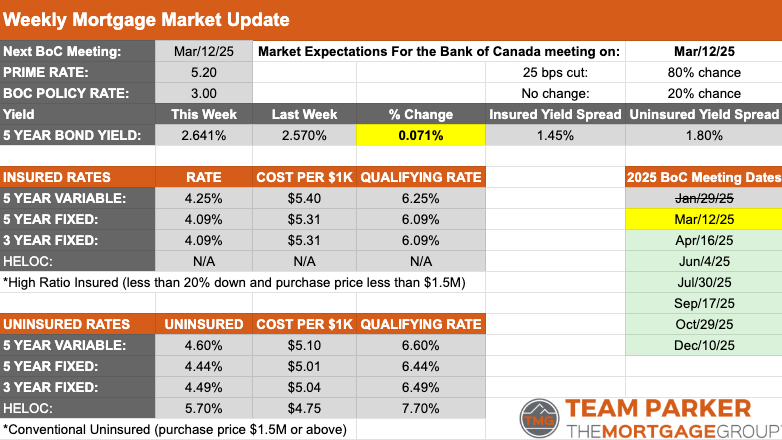

📉 Key Market Rates:

How does that compare to our own poll? 🗳️ Your votes so far:

👏 Thanks to everyone who voted! If you haven’t yet, cast your vote here: Rate Announcement Poll » |

|

|

|

If you have any questions about the current market, interest rates, or your mortgage options, don’t hesitate to reach out. I’m happy to help! Best, Matt Parker |